COURSE OVERVIEW:

Financial Statement Analysis is the study of the measurement and evaluation of business performance and business risk through the interpretation of financial reporting information. It examines both strategic and operational perspectives of an organization by analyzing the major financial statements and the meaning of the numbers presented within them. Through structured financial analysis, organizations are able to assess performance, evaluate risk, and support informed decision-making.

This course develops a critical understanding of financial reporting techniques and the application of key financial principles to measure business success and promote value creation. Students will learn how to interpret accounting information, form and analyze financial ratios, and evaluate both short-term and long-term liquidity positions. Emphasis is placed on understanding how financial statements reflect operational realities and how they can be used to identify strengths, weaknesses, risks, and opportunities.

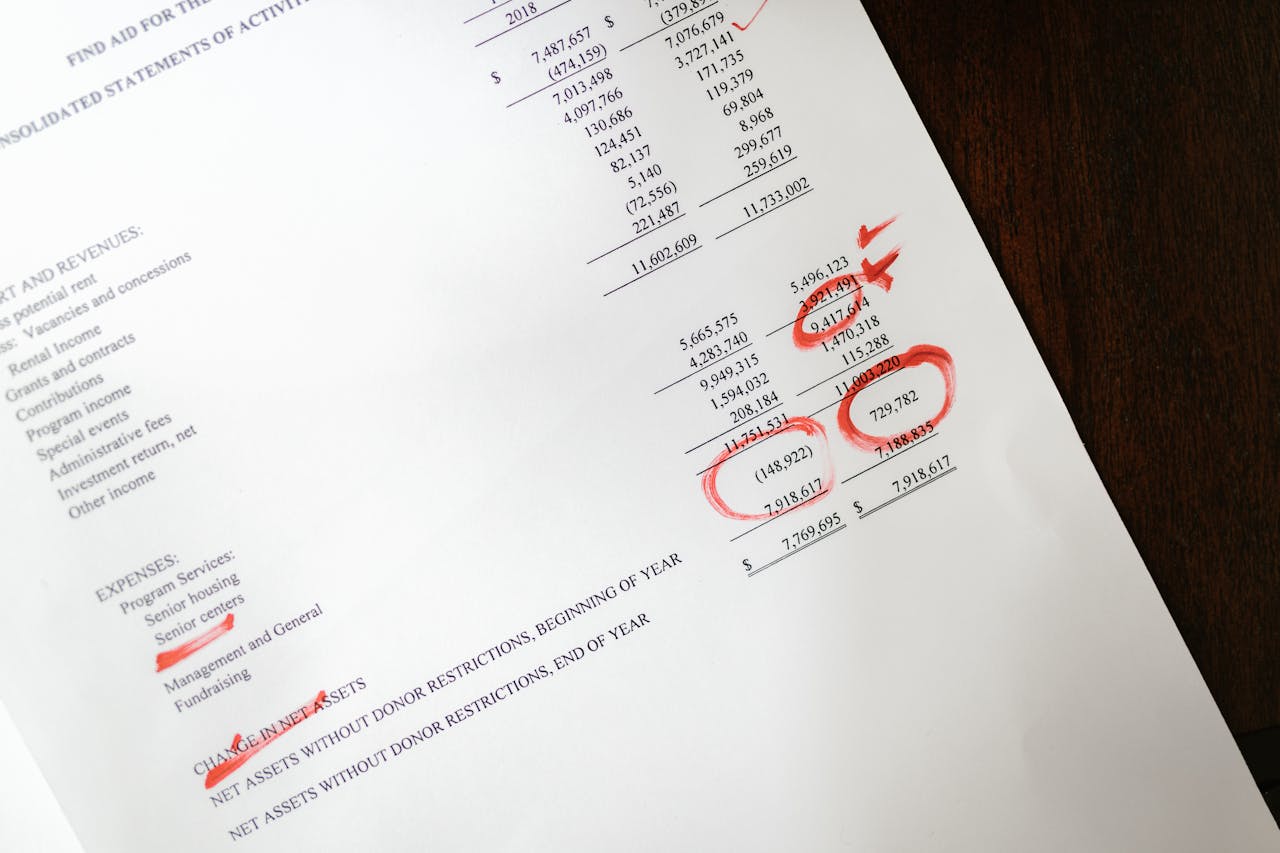

The method for accomplishing this includes detailed examination of the income statement, balance sheet, and cash flow statement; calculation and interpretation of financial ratios; application of quantitative and qualitative analytical models; and evaluation of business performance through case studies and practical exercises. Students will also explore the limitations of financial statements and develop professional skills in problem solving, communication, and decision-making.

Among the topics included in this course are: the framework for financial statements, purpose and structure of accounting reports, interpretation of accounting data, users of financial information, liquidity and solvency analysis, profitability and efficiency ratios, risk assessment, corporate failure prediction models, and value creation analysis.

LEARNING OUTCOMES:

Upon completion of this course learners will be able to:

-

Explain the framework, purpose, underlying concepts, and format of financial statements.

-

Interpret accounting information to evaluate business performance and financial health.

-

Identify and analyze the needs of various users of financial information and understand the limitations of financial statements.

-

Calculate and interpret key financial ratios related to liquidity, profitability, efficiency, and solvency.

-

Apply quantitative and qualitative models in assessing corporate performance and potential failure.

-

Evaluate short-term and long-term liquidity requirements of an organization.

-

Use financial analysis techniques to support strategic and operational decision-making.

-

Communicate financial findings clearly in both written and verbal formats.